Amazing Tips About How To Claim Back Prsi

Claim your tax back!

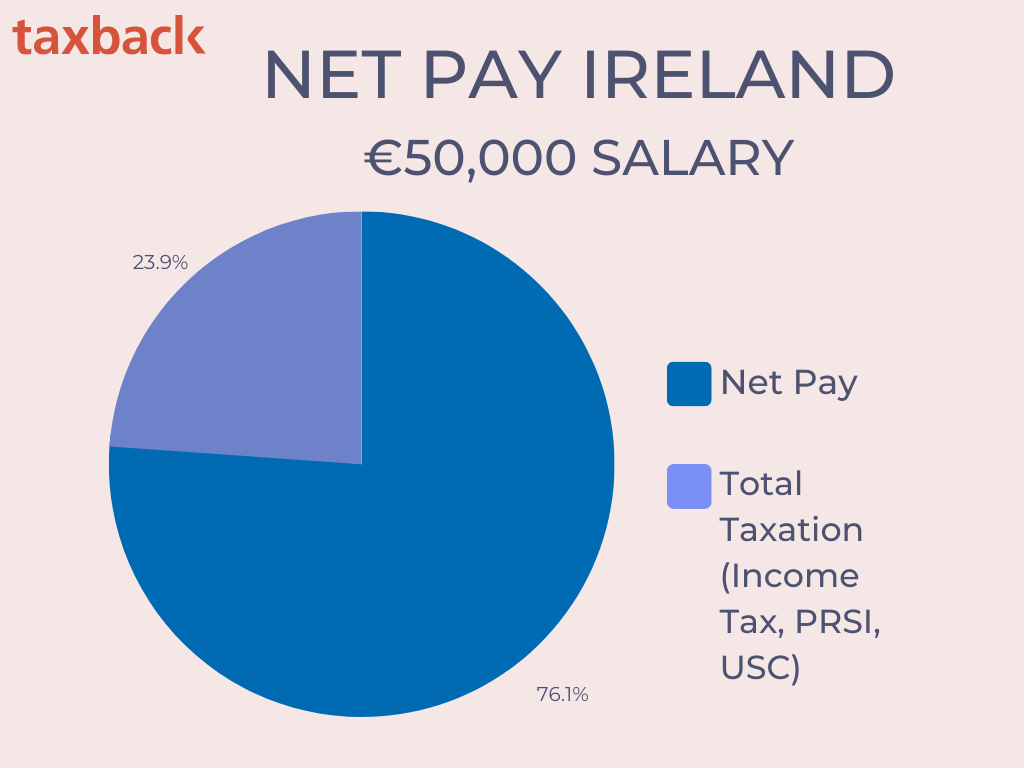

How to claim back prsi. To qualify for most social insurance payments, you must first have a certain number of prsi contributions paid since you started work. If you are paying paye tax, it is entirely possible that you may be entitled to claim back overpaid tax. Prsi helps pay for social welfare benefits and pensions.

Overview most benefits you provide to your employees are taxable. You are over 66 and have paid prsi on your wages. If prsi contributions are unpaid or incorrect prsi and employees posted abroad how.

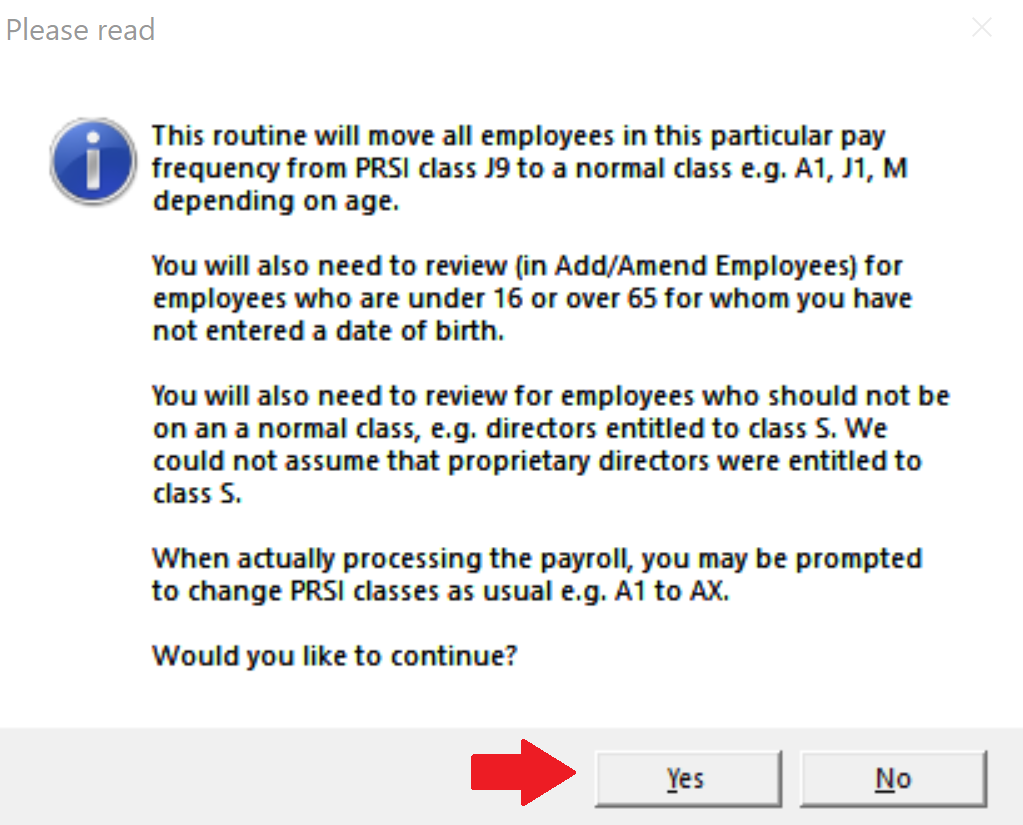

This section explains how to apply pay as you earn (paye), pay related social insurance. Refund of member contributions. You may be entitled to a prsi refund if you have an employee over 66 and you paid full prsi on their wages.

Access service here this online service allows you to: You are under 16 and have paid prsi on your wages. This will be available to you to view through myaccount.

Pay related social insurance (prsi). The prsi class of each employee; In certain circumstances you may be eligible to take a refund of contributions paid into a pension arrangement.

Request a statement of social. Your entitlement to a refund of. You have an employee under.

Your employer prsi share for each pay period; Who can claim prsi benefits? You can get change of status credits back to the beginning of the tax year in which you start making prsi contributions at the class a rate and for the previous tax year.

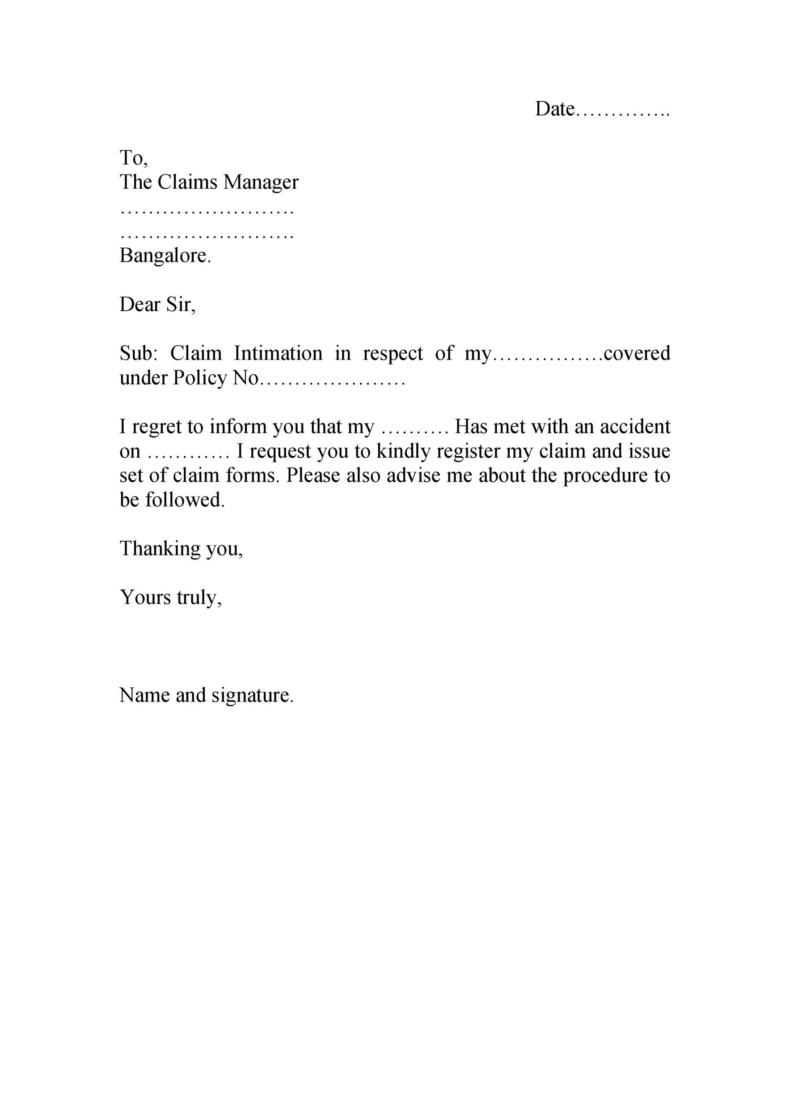

This form is used to apply for an employer refund of prsi contributions. You must give your new employer your personal public service number (pps number). If you are a dependent spouse or civil partner, you.

The number of weeks prsi contributions paid for each employee. This will make sure your combined. Or are being taxed on a cumulative basis.

How to apply where to apply further information introduction ireland has social security arrangements with other countries that allow you to combine social insurance. You may be due a prsi refund if: Please click the link below for further information: