What Everybody Ought To Know About How To Get Out Of A Prepayment Penalty

The concept of prepayment penalty can be confusing, but it’s important to understand how it works before taking out a loan.

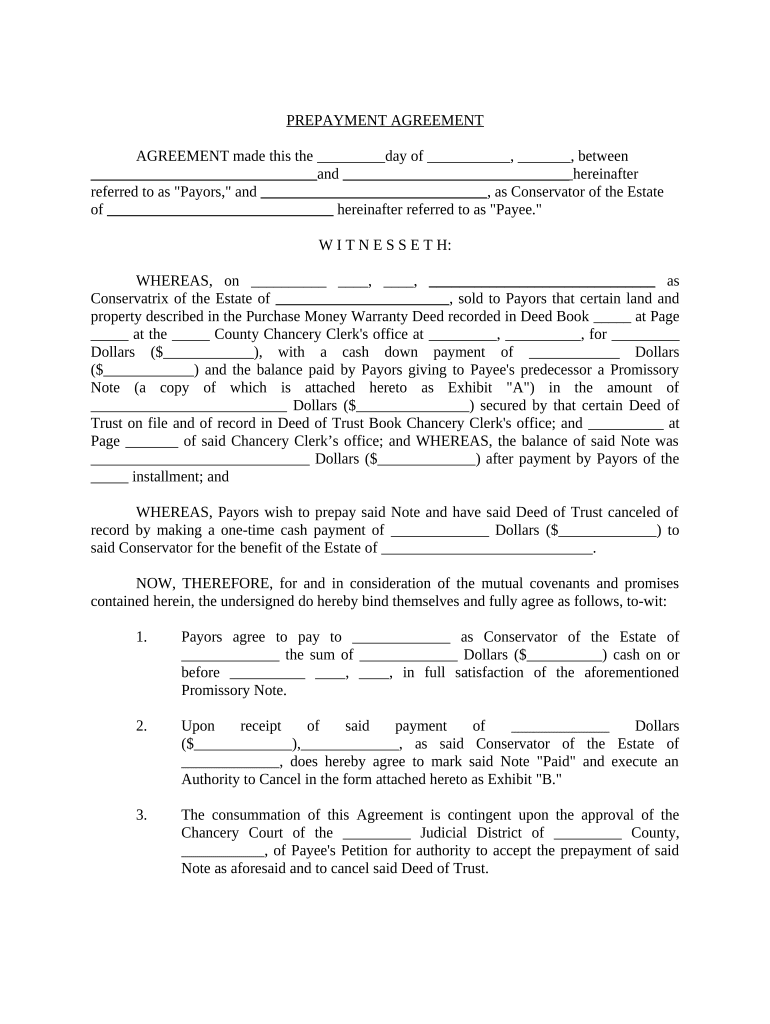

How to get out of a prepayment penalty. Can you provide a loan option without a prepayment penalty? So, in order to help you out, we’ll. A prepayment penalty, also known as an early payoff penalty, is a fee you incur when you pay back your loan ahead of the predetermined schedule.

What’s prepayment penalty and how does it work? The type of prepayment penalty you’ll pay may depend on the type of mortgage you get and your lender’s practices. We’ll talk about its costs.

If there’s no prepayment clause, your lender has to comply. Another option is to try to negotiate with. Limits on prepayment penalties on fixed.

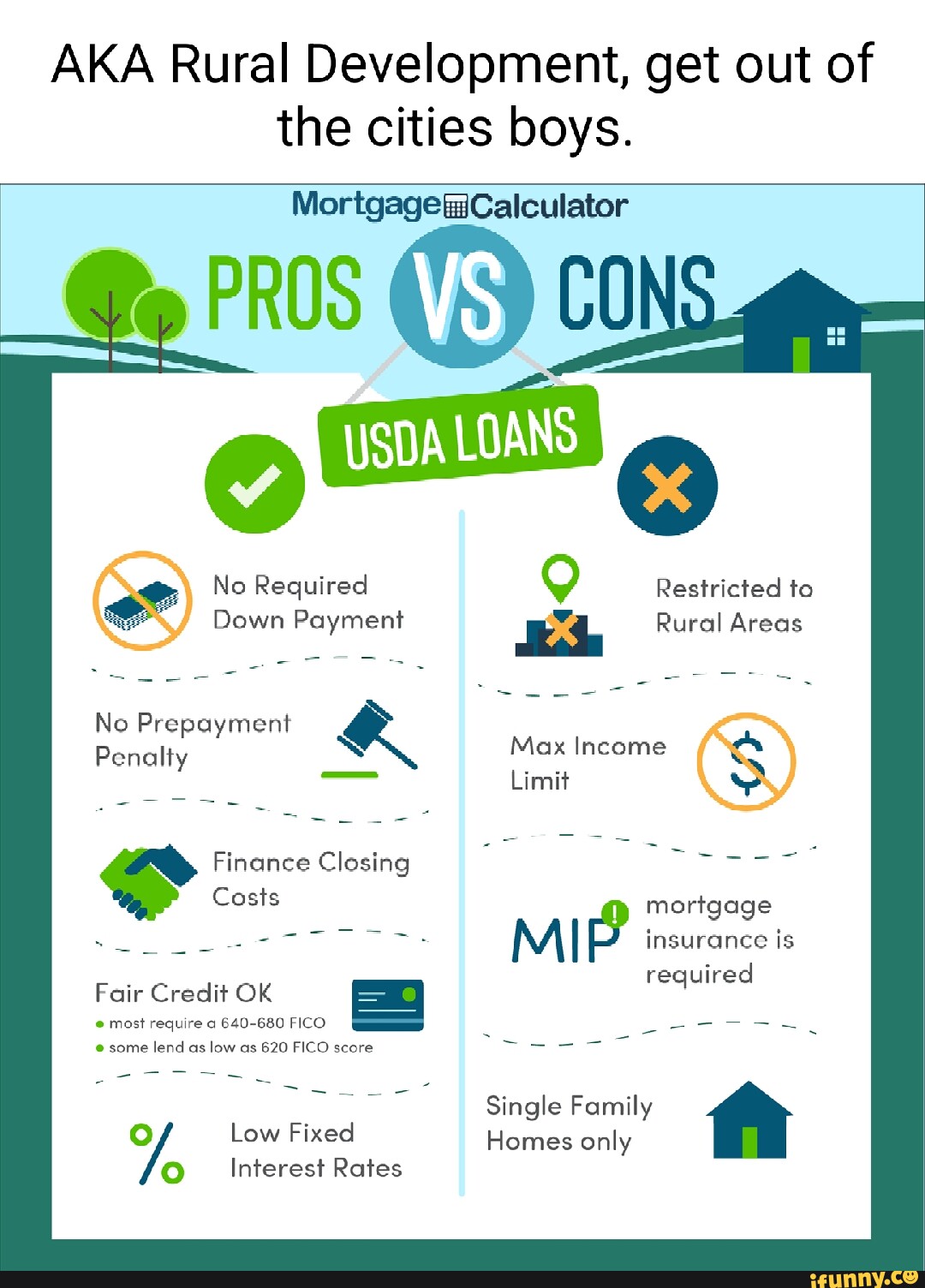

If you want to avoid prepayment penalties on your next mortgage loan, there are certain lenders to avoid. If your lender does have a prepayment penalty, you can simply choose to not pay off your loan early to avoid the penalty. Reach out to your lender and request that your money be applied to the principal.

Ratehub.ca’s mortgage penalty calculator captures your required inputs, determines your prepayment penalty and shows you the corresponding calculations for the curious. The mortgage penalty calculator helps you estimate the prepayment penalty or charge that would apply if you prepaid your mortgage loan. It serves as a financial penalty to.

A prepayment penalty is a fee or charge imposed by a lender on a borrower for paying off a loan or mortgage before the scheduled due date. Some lenders charge a fee that is a percentage of the mortgage’s. If you have already taken out a mortgage, car loan, or personal loan and you’re not sure whether.

Find out the type of prepayment penalty that comes with your mortgage and compare the cost of staying in your current loan past the penalty date with the cost of. If you’ve taken out an amortized loan with no prepayment penalty clause, you’ll be forgiven interest by paying down the debt early. In this article, we’ll explain how borrowers are charged for paying off their mortgage too quickly.